Having life insurance is a way to ensure that your loved ones have financial protection after your passing while also helping you build wealth and save for retirement. But could life insurance also be an investment? Yes, it can – if used correctly.

Many people ask: is life insurance a good investment strategy? The answer to this question depends on your needs, financial goals, and risk tolerance. If you’re a long-term investor, life insurance can be a great way to plan for retirement and build wealth over time. Here, we will help you clarify some doubts for you to decide!

Is Life Insurance a Good Investment Strategy?

Life insurance can be divided into two types: term and permanent. While both provide death benefits, only permanent life insurance can accumulate monetary value.

This is due to the fact that permanent policies, such as whole life insurance, include a reserve known as the “cash value.” A percentage of your premium is allocated to the cash value, which grows tax-free. You can withdraw or borrow against the funds to cover costs while living.

How Does Life Insurance Work as an Investment?

Life insurance can have some investment components, primarily in the case of permanent life insurance policies like whole life and universal life. These policies offer a death benefit to protect your beneficiaries and a cash value component that can be considered an investment feature. Here’s how life insurance works as an investment:

Premium Payments

When you purchase a permanent life insurance policy, you agree to pay regular premiums to the insurance company. Part of these premiums goes towards the cost of insurance coverage (death benefit), and the rest goes into the cash value component.

Cash Value Accumulation

The cash value is essentially a savings account within the insurance policy. Over time, the cash value accumulates based on a combination of factors, including the performance of the insurance company’s investment portfolio, the policy’s interest rate, and any applicable fees or expenses.

Tax Advantages

The cash value growth in permanent life insurance policies grows on a tax-deferred basis. This means you won’t owe income taxes on the cash value’s growth as long as it remains within the policy. However, if you surrender the policy or take withdrawals, there may be tax consequences.

Borrowing and Withdrawals

Policyholders can access the cash value through policy loans or withdrawals. Policy loans typically impact the policy’s cash value less, as the insurance company uses the policy as collateral. Withdrawals may reduce the cash value and the death benefit.

Death Benefit and Payout

When the policyholder passes away, the beneficiaries receive the death benefit, which is the face value of the policy (the initial coverage amount) plus any accumulated cash value minus any outstanding loans or withdrawals.

Pros of using life insurance as an investment

- Tax-deferred growth: The cash value grows without incurring annual income taxes.

- Guaranteed returns: Some types of permanent life insurance come with guaranteed minimum interest rates, providing stable growth.

- Creditor protection: In many jurisdictions, life insurance policies offer protection from creditors.

Cons of using life insurance as an investment

- More suitable investment options might be available if you do not require insurance.

- Typically, your heirs will not receive the cash value from your policy as part of the death benefit.

- The cash value can be subject to surrender charges if you terminate the policy before it matures.

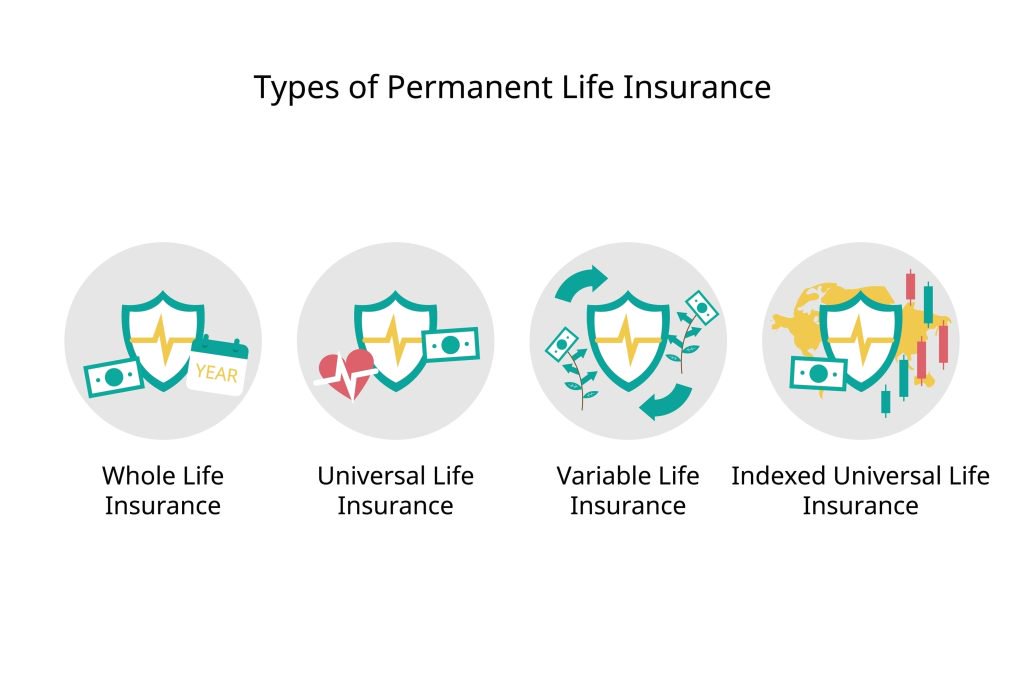

Life Insurance Policies that Can Be Used as an Investment

Cash value growth is determined by several factors, such as the policy type, the duration of coverage, the amount of payment made into the account, and the terms of your policy. Some of the policies you can use as an investment are:

- Whole life insurance

- Universal life insurance

- Variable universal life insurance

- Indexed universal life insurance

- Variable universal life insurance

With these insurance policies, you can accrue cash value over time for various purposes, such as retirement planning, education funding, supplementing income, or providing cash to your beneficiaries during your death.

How to Invest in Life Insurance Policies?

Investing in life insurance policies involves purchasing existing ones from policyholders on the secondary market through the life settlement industry. You’ll need to understand:

- The regulations

- Assess investment opportunities

- Conduct due diligence on policies

- Evaluate risk and return

- Seek professional advice

- Negotiate

- Monitor the investment.

Keep in mind that it’s a specialized and complex investment with potential risks. Therefore, it’s important to research and take expert advice before investing.

What to Look Out For?

When investing in life insurance policies, knowing the risks is important. These include:

- Policy lapse risk: The policy may lapse if the policyholder fails to make premium payments.

- Unexpected costs: Additional expenses may be associated with purchasing and managing a life insurance policy that is not immediately apparent when you make your initial investment.

- Liquidity risk: The illiquid nature of a life insurance policy may make it difficult to liquidate if you need cash quickly.

Investing in life insurance is not for everyone, but if it fits your financial strategy and investment goals, it can be an excellent way to build wealth over time. Before investing, make sure you fully understand the risks associated with it.

Work with Pronto Insurance!

Life insurance can be a smart investment for those seeking to build wealth over the long term. It offers tax-deferred growth and creditor protection and the potential to generate returns greater than traditional investments such as stocks and bonds. However, it is important to understand the risks associated with investing in life insurance policies.

At Pronto Insurance, we have the expertise and knowledge to help you make an informed decision. We offer a variety of life insurance policies that can be tailored to your individual needs and financial goals. Contact us today to learn more about how we can help you invest in life insurance!